Mortgage Loan Rate Trend in the USA: What You Need to Know

As a prospective homeowner or someone looking to refinance, understanding the mortgage loan rate trend in the USA is crucial. Mortgage rates fluctuate due to various factors, and staying informed can save you money and help you make better financial decisions. In this blog, we’ll explore the current trends, factors affecting mortgage rates, and tips for securing the best rates.

Understanding Mortgage Loan Rates

What Are Mortgage Loan Rates?

Mortgage loan rates are the interest rates that borrowers pay on their home loans. These rates are determined by lenders and can vary based on the type of mortgage, the borrower’s creditworthiness, and other economic factors.

Fixed vs. Adjustable Mortgage Rates

- Fixed-Rate Mortgages: These offer a consistent interest rate throughout the life of the loan, providing stability and predictable payments.

- Adjustable-Rate Mortgages (ARMs): These start with a lower initial rate, which can change over time based on market conditions. ARMs may be appealing in a low-rate environment but can lead to higher payments if rates increase.

Current Mortgage Loan Rate Trends in the USA

Historical Overview

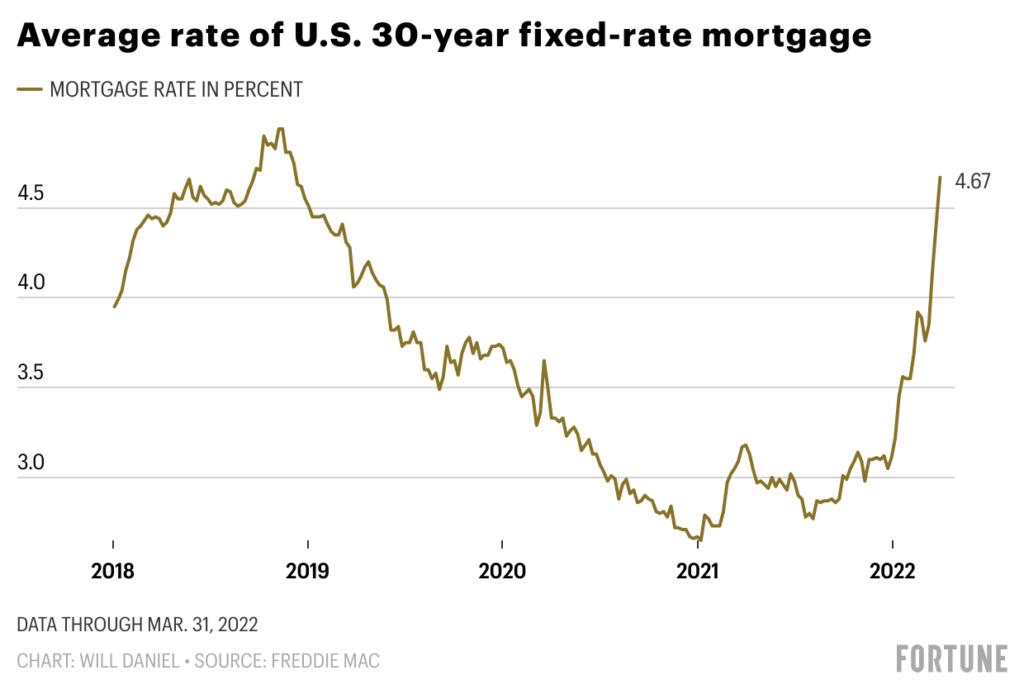

Over the past decade, mortgage rates in the USA have seen significant fluctuations. After reaching historic lows during the COVID-19 pandemic, rates have begun to rise as the economy recovers.

Recent Trends in 2024

As of 2024, mortgage rates in the USA have been trending upward due to various economic factors, including inflation and changes in Federal Reserve policies. The average rate for a 30-year fixed mortgage has been hovering around [insert current rate], while 15-year fixed and adjustable-rate mortgages have also seen increases.

Regional Variations

Mortgage rates can vary by region due to differences in local housing markets, economic conditions, and lender competition. It’s important to compare rates in your specific area to get the best deal.

Factors Influencing Mortgage Loan Rate Trends

Federal Reserve Policies

The Federal Reserve plays a significant role in influencing mortgage rates. When the Fed raises interest rates to combat inflation, mortgage rates often follow suit. Conversely, rate cuts can lead to lower mortgage rates.

Economic Indicators

- Inflation: High inflation typically leads to higher mortgage rates as lenders seek to protect their returns.

- Employment and Wage Growth: Strong economic growth and rising wages can push rates higher, while economic downturns may result in lower rates.

- Bond Market: Mortgage rates are closely tied to the yields on 10-year Treasury bonds. When bond yields rise, mortgage rates tend to increase as well.

Housing Market Conditions

The supply and demand in the housing market also influence mortgage rates. In a competitive market with high demand, rates may rise as lenders have more borrowing opportunities.

Tips for Navigating Mortgage Loan Rate Trends

Monitor Rates Regularly

Keep an eye on the mortgage loan rate trend to identify the best time to lock in a rate. Use online tools and resources to track rate changes and stay informed.

Improve Your Credit Score

A higher credit score can help you secure a lower mortgage rate. Pay off debt, avoid new credit inquiries, and ensure your credit report is accurate before applying for a mortgage.

Consider Different Loan Options

Explore various loan options, including fixed-rate and adjustable-rate mortgages, to find the one that best suits your financial situation. Work with a mortgage advisor to understand the pros and cons of each option.

Shop Around

Don’t settle for the first rate offer you receive. Compare rates from multiple lenders, including banks, credit unions, and online lenders, to find the best deal.

Lock in Your Rate

If you find a favorable rate, consider locking it in to protect yourself from potential increases. Rate locks can last from 30 to 60 days, giving you time to complete your home purchase or refinancing.

Conclusion

Understanding the mortgage loan rate trend in the USA is essential for making informed decisions about home buying or refinancing. By staying informed, improving your credit score, and shopping around, you can secure the best possible rate and save money in the long run. Keep an eye on economic indicators, Federal Reserve policies, and housing market conditions to navigate the ever-changing landscape of mortgage rates.

Whether you’re a first-time homebuyer or a seasoned investor, knowledge is power when it comes to mortgage rates. Stay ahead of the trends and make your homeownership dreams a reality.