How to Find Cheap Car Insurance in the USA

Finding cheap car insurance in the USA can be a challenge, but it’s possible with the right approach. While the cost of car insurance varies depending on multiple factors, there are effective ways to reduce your premiums and still get adequate coverage. In this blog, we’ll explore the key strategies for finding cheap car insurance, the factors affecting the cost, and tips to save money while keeping your vehicle protected.

Why Cheap Car Insurance Matters

Car insurance is essential for any driver in the USA, but high premiums can put a strain on your finances. The right cheap car insurance offers financial protection without breaking the bank. It ensures that in case of an accident, your expenses are covered without leaving you in financial trouble.

Factors That Affect Car Insurance Costs

Before diving into how to find cheap car insurance, it’s important to understand the factors that influence car insurance premiums. These factors are key to determining the final cost of your policy:

- Driving Record: A clean driving record with no accidents or traffic violations can significantly lower your premium.

- Location: Urban areas tend to have higher insurance rates due to the increased likelihood of accidents and theft.

- Vehicle Type: Expensive or high-performance cars are typically more costly to insure.

- Age and Experience: Younger drivers and those with less experience tend to pay more for car insurance.

- Credit Score: In many states, a higher credit score can lower your car insurance premium.

Top Tips for Finding Cheap Car Insurance

1. Compare Quotes from Multiple Insurers

One of the easiest ways to find cheap car insurance is to compare quotes from multiple providers. Rates can vary dramatically from one insurer to another, so shopping around is essential. Many online tools allow you to compare quotes quickly and easily, saving you both time and money.

2. Choose the Right Coverage

While it’s important to have adequate coverage, you may not need every optional add-on that insurance companies offer. Opting for only the coverage you need can significantly lower your premium. For example, if your car is older, you may not need comprehensive or collision coverage.

3. Increase Your Deductible

Raising your deductible is a quick way to lower your insurance premium. The deductible is the amount you pay out of pocket before your insurance kicks in. By choosing a higher deductible, you can reduce your monthly premium. However, make sure you can afford to pay the deductible if you need to file a claim.

4. Take Advantage of Discounts

Many insurance companies offer discounts that can help you find cheap car insurance. These discounts may include:

- Good Driver Discounts: For those with a clean driving record.

- Multi-Policy Discounts: Bundling your car insurance with other policies like home or renters insurance.

- Low Mileage Discounts: If you don’t drive your car often, you may qualify for lower rates.

- Good Student Discounts: For students who maintain good grades.

Make sure to ask about available discounts when getting quotes from insurers.

5. Improve Your Credit Score

In many states, your credit score plays a significant role in determining your car insurance rates. By improving your credit score, you can often secure cheap car insurance. Simple steps like paying bills on time and reducing credit card balances can positively impact your score and lower your premiums.

6. Drive Safely and Maintain a Clean Record

Your driving history is one of the most important factors in determining your car insurance rates. Avoiding accidents and traffic violations can help you qualify for cheap car insurance over time. Many insurers offer safe driving programs that monitor your driving habits and offer discounts for safe behavior.

7. Consider Usage-Based Insurance

Some insurance companies offer usage-based insurance programs, which can be a great option if you don’t drive much. These programs use telematics devices or mobile apps to track your driving habits and offer lower rates based on your actual driving patterns. If you’re a safe, low-mileage driver, usage-based insurance could be the key to finding cheap car insurance.

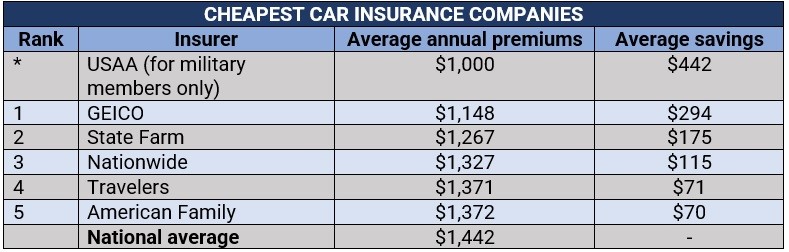

Best Cheap Car Insurance Providers in the USA

There are several car insurance companies in the USA that consistently offer cheap car insurance. Some of the most affordable providers include:

- GEICO: Known for offering competitive rates, especially for good drivers and students.

- State Farm: Offers a variety of discounts and great service, with options for bundling policies.

- Progressive: Offers discounts for safe driving and usage-based insurance options.

- USAA: Provides affordable insurance for military personnel and their families.

When choosing a provider, make sure to weigh the cost of premiums against the level of customer service and claim handling.

Is Cheap Car Insurance the Right Choice?

While saving money is important, it’s crucial to balance cost with coverage. Cheap car insurance should still provide you with the protection you need. If you choose the lowest possible coverage limits, you could end up paying more out of pocket in the event of an accident. Before opting for the cheapest policy, ensure that it meets the minimum state requirements and covers your needs in case of an accident or theft.

Conclusion

Finding cheap car insurance in the USA doesn’t have to be a hassle. By comparing quotes, choosing the right coverage, and taking advantage of discounts, you can secure affordable car insurance that meets your needs. Remember that your driving habits, vehicle, and location all play a role in the cost of your insurance, so tailor your search to find the best rates for your situation. With a little effort, you can find the perfect balance of affordability and coverage for your vehicle.

Pingback: Car Insurance Companies in the USA - Trends