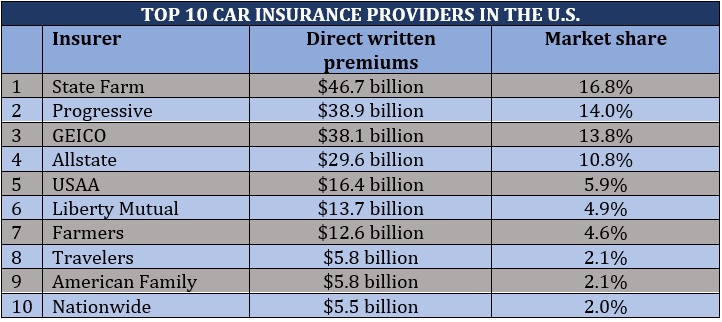

Top Car Insurance Companies in the USA

Choosing the right car insurance is a crucial decision for every driver. With numerous options available, finding the best one can be overwhelming. This blog will explore the top car insurance companies in the USA, breaking down their strengths, coverage options, and what makes each stand out.

Why Choosing the Right Car Insurance Company Matters

Before diving into the list of top car insurance companies in the USA, it’s important to understand why this decision is so essential. The right car insurance provides financial protection, ensures you comply with legal requirements, and gives you peace of mind on the road. Different companies offer varying levels of customer service, discounts, and coverage options, making it essential to choose wisely.

1. State Farm

State Farm is often ranked as one of the top car insurance companies in the USA due to its extensive network of agents, reliable customer service, and affordable pricing.

Key Features:

- Wide range of coverage options: State Farm offers comprehensive, collision, liability, and rental car coverage.

- Discounts: Good driver discounts, multi-policy discounts, and savings for bundling home and auto insurance.

- Strong financial stability: Rated highly for its ability to pay claims and provide long-term financial stability.

State Farm is especially popular with drivers looking for a personalized experience, thanks to its large network of agents across the country.

2. GEICO

Known for its catchy commercials, GEICO is also a leader when it comes to affordable car insurance. As one of the top car insurance companies in the USA, GEICO is recognized for its ease of use and competitive rates.

Key Features:

- Low premiums: GEICO is one of the most affordable options for drivers of all ages.

- User-friendly app: The mobile app allows you to manage your policy, file claims, and get roadside assistance quickly.

- Available discounts: Includes discounts for good drivers, military personnel, federal employees, and students.

GEICO’s strength lies in its affordability and accessibility, making it a go-to for those seeking cheap and reliable insurance coverage.

3. Progressive

Progressive is another heavyweight among the top car insurance companies in the USA. Known for its innovative approach, Progressive offers a unique feature called the “Name Your Price” tool, which allows customers to find policies that fit their budget.

Key Features:

- Snapshot program: Drivers can get discounts by enrolling in this usage-based program that tracks driving habits.

- Comprehensive coverage: Offers options like gap insurance, rideshare coverage, and custom parts protection.

- Large network of services: Progressive also provides 24/7 customer service and a large network of repair shops.

With its innovative technology and diverse coverage options, Progressive appeals to tech-savvy drivers who want flexibility in their policies.

4. Allstate

Allstate is renowned for its customer service and extensive coverage options, making it one of the top car insurance companies in the USA. Allstate is a strong choice for drivers who prioritize good customer support and access to a local agent.

Key Features:

- Accident forgiveness: Your rates won’t increase after your first accident.

- Drivewise program: Similar to Progressive’s Snapshot, Allstate offers discounts for safe driving through a usage-based insurance program.

- Numerous discounts: From new car discounts to multi-policy discounts, Allstate offers multiple ways to save on your premium.

Allstate is best for drivers who prefer personalized service with the option to tailor coverage to fit their unique needs.

5. USAA

USAA is consistently ranked as one of the top car insurance companies in the USA but is only available to military members, veterans, and their families. Despite its restricted availability, USAA offers excellent service and some of the lowest premiums in the industry.

Key Features:

- Highly rated for customer satisfaction: USAA is known for exceptional customer service and quick claims processing.

- Affordable rates: Often considered one of the most cost-effective options for eligible members.

- Additional coverage: Includes options like comprehensive and collision coverage, as well as rental car reimbursement.

For military families, USAA is the gold standard in car insurance, offering unparalleled support and value.

6. Farmers Insurance

Farmers Insurance is another leading choice among the top car insurance companies in the USA, especially for drivers who want a broad array of coverage options.

Key Features:

- Customizable policies: Farmers allows you to tailor your policy with a wide range of optional add-ons, like new car replacement and rideshare coverage.

- Safe driver discounts: Farmers rewards drivers who maintain a clean driving record with substantial discounts.

- Strong customer support: Farmers is known for providing reliable customer service and handling claims quickly.

Farmers is ideal for drivers looking for flexibility in their coverage with strong customer service support.

7. Liberty Mutual

Liberty Mutual stands out for its wide range of customization options, making it a favorite among drivers looking for tailored coverage plans.

Key Features:

- Customizable coverage: Includes everything from accident forgiveness to new car replacement and better car replacement.

- 12-month rate guarantee: Liberty Mutual offers policies that lock in your rate for 12 months, providing stability in premium costs.

- Roadside assistance: Liberty Mutual provides free roadside assistance with many of its policies.

Liberty Mutual’s robust customization options make it a strong contender for drivers looking for highly personalized insurance solutions.

Conclusion

The top car insurance companies in the USA offer a variety of coverage options, pricing plans, and customer service experiences to meet the diverse needs of drivers. Whether you prioritize affordability, personalized service, or innovative technology, there’s an insurance provider to suit your needs. When selecting a company, it’s important to consider not only the cost but also the type of coverage and level of customer service you’ll receive. Compare quotes and explore discounts to find the best option for your car insurance needs.